For more than 100 years, the globe has been racing fast as countries focus on industrialization. Emerging economies have been trying to catch up with the already industrialized countries, but concerns for sustainability were shoved behind. People rarely focused on sustainability, and the results have been rapid damage to the environment, global warming, loss of biological diversity, and inequality.

The notion that resources on the planet are infinite was incorrect. For example, damaging tropical forests for timber means loss of biological diversity, the inability of the globe to absorb excess carbon dioxide from the atmosphere and accelerated global warming. Some of these trees are older than 300 years and growing more to that level is never easy. They are invaluable treasures for this planet. Therefore, it is time to remedy all the ills facing society, and the best method, which is stakeholder-driven, is ESG sustainability reporting.

In this post, we take a closer look at ESG reporting to demonstrate what it is and the risks of failing to adopt it.

A Brief History of ESG sustainability Reporting

The idea of sustainability is relatively new, having been introduced to the globe about 30 years ago. It was first brought forth in the first UN Conference on Environment and Development (UNCED) of 1992 in Brazil. During the meeting, member states raised concerns about the rapid damage to the environment and concluded that you could not look at the environment separately from the development. This “discovery” was built upon to look for an effective way of restoring the planet’s lost glory, finally yielding the current idea of sustainability reporting.

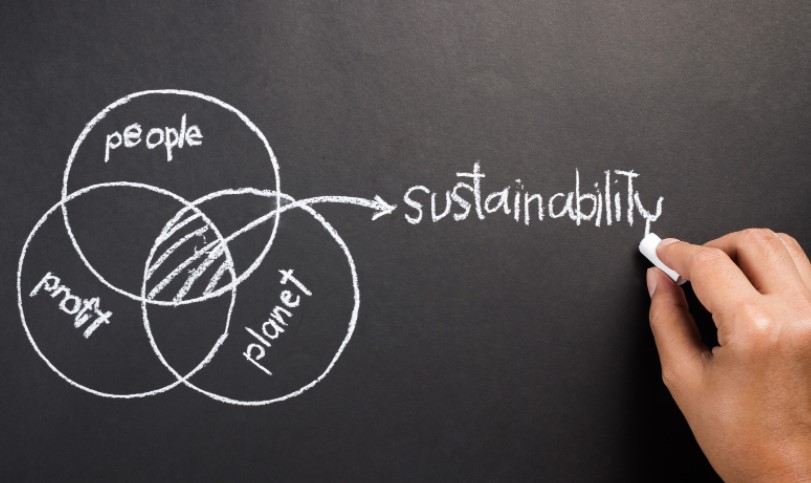

Environmental, social, and governance (ESG) reporting is the process of disclosure of a company’s information on its efforts on sustainability. The aim is to create a report that stakeholders can read, understand the efforts on responsible operations, and make the decision to invest, buy, or be associated with your company.

Although the focus is creating a report for stakeholders, the process of ESG reporting goes far beyond that. It is a way of revitalizing a company’s design to adopt the best practices and make it responsible.

The Risks of Failing to Use ESG Sustainability Reporting

We must indicate that although ESG reporting has largely been voluntary, the benefits and successes achieved so far are persuading governments to make it mandatory. So, here are the risks of not using ESG reporting.

- The Danger of Getting Delisted from Stock Exchanges

Even before governments can make ESG reporting part of their policies, stock exchanges have moved with speed and adopted it. From the London Stock Exchange (LSE) to Hong Kong Stock Exchange (HKEX), one of the primary requirements for listing is ESG reporting. So, if your company is listed, there is a risk of getting delisted for not complying with ESG reporting guidelines. Delisting will be a huge loss because it damages a company’s image and cuts channels for raising capital.

- The Risk of Getting into Conflict with Laws

As we indicated already, more governments are moving towards making ESG reporting mandatory. Some jurisdictions, such as the EU, have already introduced new laws. The EU’s Taxonomy regulation is focused on helping stakeholders determine if an action by a business is sustainable or not. Most countries also have individual laws on pollution, emissions, labor, and ethics that you can address with ESG reporting. Therefore, failure to adopt good ESG reporting sets your firm on a path to conflict with laws. You might even lose your trading license!

- Loss of Market Share

The biggest demand for ESG reports comes from stakeholders. Customers no longer want to buy products made using child labor, harmful technologies, or products that damage the environment. So, failing to produce ESG reports is like telling everyone that “our production does not follow the best practices.” Your customers will run away and the market share could shrink fast.

As you can see, the dangers of not using sustainability reporting could signal the start of the crumbling of your company. Do not let it come to that. You can get started right away by acquiring the right ESG sustainability reporting software. The program helps to cut down associated costs, automates the process of data collection, and report generation. Visit Diginex.com for the best reporting apps for your company.